Product Update:

Cardinal financial has updated its conventional loan limit to $750,000 in anticipation of Fannie Mae and Freddie Mac’s 2024 loan limit release.

- A buyer can put as little as 3% down on a sales price up to $773,000 if they are a first-time home buyer.

- A buyer can put as little as 5% down on a sales price up to $789,500.

- A buyer can put as little as 10% down on a sales price up to $1,388,888 (by coupling a conventional loan with a 2nd mortgage line of credit)

Tired of financing falling through??

I am now guaranteeing up to $5,000 of our buyer’s earnest money deposit if I issue an approval letter and fail to secure financing 😊. (assuming the loan application is deemed accurate). The Maltese Group has zero cracked eggs (declined loans) for 2023.

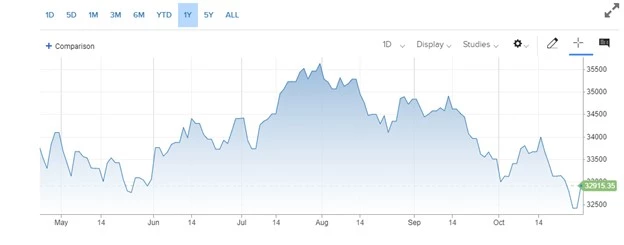

Financial Markets- Stocks

The horrible conflict in the Middle East triggered a sizable sell off in stocks, with the Dow Jones dropping nearly 1,500 points before bouncing back 500 pts. Ordinarily a geopolitical conflict such as the one going on in Gaza would have triggered a flight to safety in the US Bond market but unfortunately that didn’t happen. All eyes will be on the Fed Reserve’s meeting Wednesday with the markets hoping the Fed will not only not raise rates but indicate they are about done raising rates.

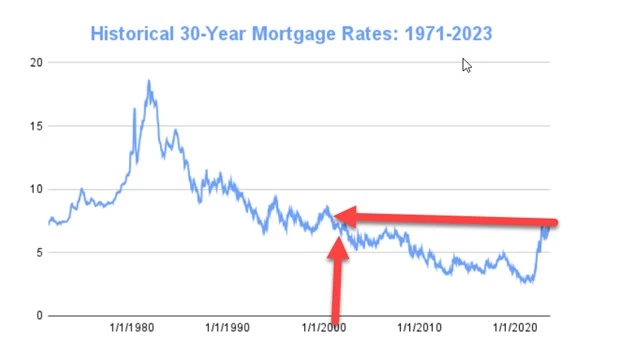

Financial Markets- Bonds (Mortgage Rates)

The 10 Year US treasury ( a bond that mortgage rates follow closely) broke 5% last week for the first time in 16 years, before receding back below 4.9%, a roughly 3% increase in 18 months.

The national average 30 year fixed rate mortgage is now just over 8%, the highest in 23 years. There is an abnormal spread between the 10 Year US treasury and the average 30 year fixed mortgage, currently over 3%, whereas traditionally the spread between the 10 year US treasury and average 30 year fixed is between 1.5% and 2%.

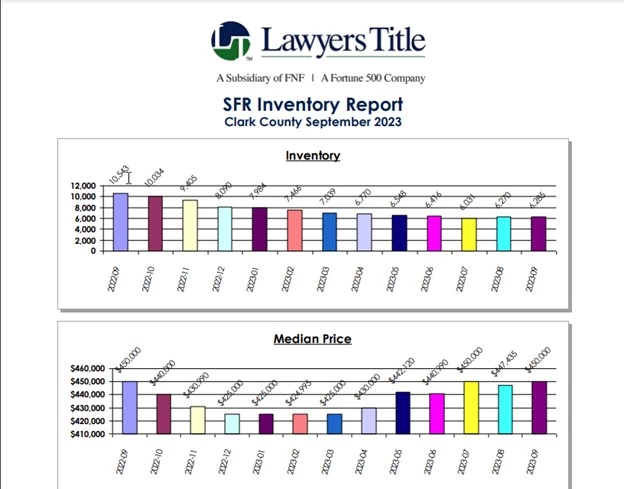

Southern Nevada Real Estate

Nearly 1,800 resale single family residences, 762 townhomes and condos, and 414 new homes exchanged hands in September for a total of just under 3,000 transactions. Roughly 30% of the transactions were paid with cash. The total number of sales for September is roughly 32% lower than the same month of what I keep calling “the last normal year”, pre-covid, 2019. Inventory of 6,285 single family residence homes gives us just over 3 months’ supply at a pace of 2,000 sales per month. The Median priced home ticked up to $450,000, down roughly 7.5% from the peak of $485,000 reached in May of 2022 but up $25,000, or over 5% for the year.

September sales again support that even with interest rates increasing, home values have continued to hold and even increase. In January of 2023 the average 30-year fixed rate mortgage was nearly 1.5% lower than the average 30-year fixed rate mortgage for the month of September yet home values have increased by over 5% during that time span. Great data to share with your clients who are concerned about a home value crash.

Message me for access to the following cutting edge realtor tools, Homebot, List Reports and Rate Plug at no cost to you!

List Reports brief description video:

https://listreports.wistia.com/medias/u3n951yoyu

Homebot brief description video:

Rate Plug brief description video: