Product Highlight of the Month- Cardinal Elite Down Payment Assistance

This may be one of the most impactful down payment assistance programs I’ve seen released in quite some time and it’s a proprietary down payment assistance program with Cardinal Financial. Here are the highlights:

- Compatible with FHA (but not Conventional or VA)

- Up to 5% of the sales price that can go towards closing costs and down payment.

- It is a 10-year term where the rate is set at 2% above the first mortgage rate of the 1st mortgage. (For example, a $20,000 DPA would cost $250 per month)

- No income cap, sales price cap debt to income ratio cap

- Min FICO 600- Just need automated underwriting approval.

- Do not need to be first-time home buyers.

- Allows for not occupying co-borrowers

- Basically, if the buyer qualifies for FHA they will qualify for this program!

Financial Markets- Stocks

The S&P 500 Index keeps on truckin, with another nearly 10% gain since my last market update in April. As we speak the Index is knocking on the door of 5500. This marks a 15% gain just in the first 6 months of the year and up 25% since November of 2023.

Financial Markets- Bonds (Mortgage Rates)

Welp, we are still here, the average 30-year fixed stubbornly hanging around 7% like a rash that won’t clear up. The 10-year US Treasury as we speak sits around 4.35%, with the average 30-year fixed rate mortgage at nearly 7.1%. The current spread between the 10-year US Treasury and the average 30-year fixed rate mortgage is about 2.8%. The historical norm up until several years ago was 1.5-2% so we are due for a roughly 1% improvement in rates if the gap between the 10-year US Treasury and the average 30-year fixed rate mortgage comes back in line with historical averages.

Speaking of the “average 30-year fixed rate mortgage”, there are a number of sources that are published daily. I like the source in this link below because it takes a survey of a number of different mortgage companies and strips out companies operating at a loss to drive in business. In comparison, Freddie Mac takes the average rate of files submitted to them which will lag behind what is happening in the market TODAY. This explains why Freddie Mac’s “average 30-year fixed” published today at 6.75, because rates were about .25% lower 2 weeks ago.

https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

Southern Nevada Real Estate

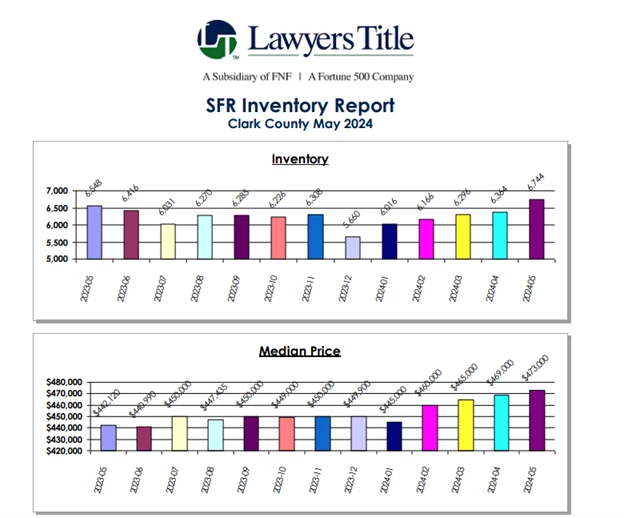

With May sales data compiled and reconciled by our friends at Lawyer’s Title, we can observe that sales have mirrored the sales activity of 2023 almost exactly. May sales stats are as follows:

- 2,860 single-family residences

- 59 condos

- 68 townhomes

- 4% cash (sorry loan officers)

- 45 of these sales were new homes (sorry loan officers without builder accounts)

This puts the year-to-date sales total at 15,115 transactions, just 51 sales less off the pace of 2023. So, the sky is falling, right? Values must be plummeting?? It’s the lowest sales pace since 2008!

Nope- Median priced home for May was $473,000. Average-priced home for May $600,098. Up roughly 7% from May 2023.

Inventory has risen slightly, which is customary for this time of year, with just over 6,700 single-family residences listed without offers. This calculates to just under 2 ½ months of supply.

The data says, don’t wait for rates to drop to buy your house. If you took this approach last May, you would have lost $35,000 in equity AND your rate is ½ percent higher! Waiting 1 year costs a home buyer over $400 per month in payment and $35,000 in home equity.

Message me for access to the following cutting-edge realtor tools, Homebot, List Reports, and Rate Plug at no cost to you!

List Reports brief description video:

https://listreports.wistia.com/medias/u3n951yoyu

Homebot brief description video:

Rate Plug brief description video: