Product Highlight of the Month

Construction to perm, One-Time Close for Conventional, FHA and VA. An alternative solution to the affordability issues home buyers are currently challenged with. This program can be used for:

1-2 unit site-built homes

Multi-width and Single-width Manufactured homes (not eligible of Investment)

Single Family Dwelling with an Accessory Dwelling Unit (ADU)

Attached and Detached Planned Unit Development (PUD)

Attached Townhome (not a condominium)

Modular home (constructed in sections off-site, but when installed at the site takes on characteristics of a site-built home; also called off-frame)

Site-Condominium (detached), must be fee simple interest for land and dwelling.

Rural Properties

Tear-downs and major renovations

Unique Properties (subject to meeting eligibility requirements per Fannie Mae)

A Veteran can do this with zero down, FHA borrowers with just 3.5% and conventional borrowers with just 5% down.

Financial Markets- Bonds (Mortgage Rates)

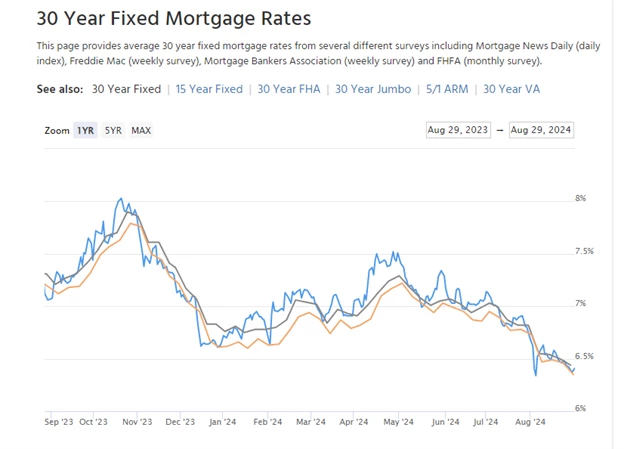

At last, at the end of July and into the first week of August, mortgage rates have begun to come down in a noticeable way. The bond market rallied as the stock market took heavy fire in the form of a sell off as a result of the weak economic data, specifically earnings and jobs report. As recently as July 25th, the 10 year US Treasury was hovering around 4.3%, and in roughly 4 weeks has dropped to below 3.9%.

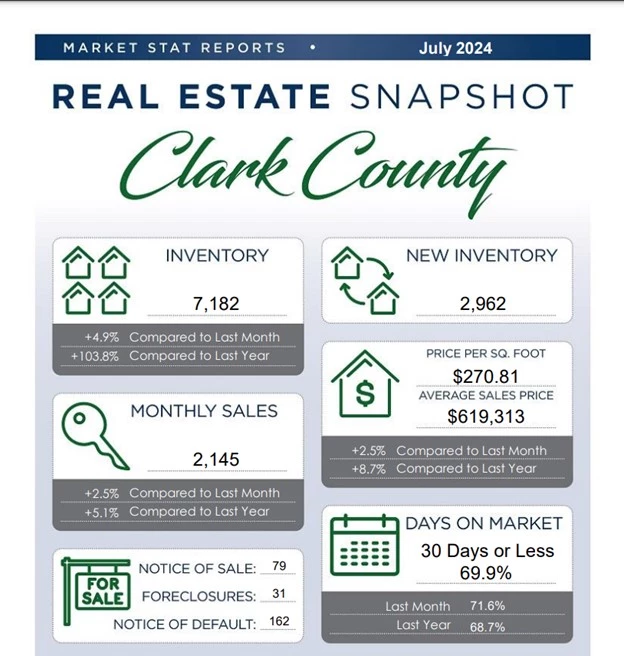

Inventory is on the rise, with nearly 7,200 single family homes on the market and roughly 2,200 getting scooped up per month, this translates into 3.3 months of supply.

The median priced home hit $480,000, just off the peak median price reached in May of 2022.

https://www.lawyerstitlenv.com/Market-Updates

The average 30 year fixed mortgage rate as a result has dropped roughly ½% in the past 30 days and a full 1% drop in the past 60 days, nestled at around 6.5% today. The spread between the 10 year US Treasury and the average 30 year fixed rate mortgage has begun to narrow as well. At one point that spread was over 3% and today it is around 2.7%. Historically this spread is around 1.5 – 2%, which means that if that spread comes back in line with historical averages, even if the bond market as a whole doesn’t improve, it would result in a 1% drop in rates.

Southern Nevada Real Estate

July home sales data compiled by Lawyer’s Title shows that 2024 home sales continue to fall behind 2023 sales pace, which was already one of the slowest sales paces for the past two decades. July home sales as follows:

2,259 Single Family Residences

345 condos

393 Townhomes

333 of these sales were new homes

28.5% paid cash

Message me for access to the following cutting edge realtor tools, Homebot, List Reports and Rate Plug at no cost to you!

List Reports brief description video:

https://listreports.wistia.com/medias/u3n951yoyu

Homebot brief description video:

Rate Plug brief description video:

https://www.rateplug.com/Agents.asp?UName=LVR